What is the funding fee on Binance?

You should know about the funding fee if you use feature trading in Binance, bybit,bitget, and in other crypto exchanges.

Funding fee in the trading account is very important in terms of

1. It can increase your profits,

2. It can decrease your profits if you don’t know about funding fees.

by the end of this article, you will able to learn about funding fee in detailed and I will share some secrets that will help you to generate some profits in your trading.

Types of Feature Contract

There are two types of feature contracts,

1. Traditional Contract: It has an expiry time like Month or Year.

2. Perpetual Contract: It has no expiry time, you can hold as long as you can, on one condition that your feature position should not liquidate.

mostly everyone uses a perpetual contract, for perpetual contract funding fees are applied.

In any exchange, you will not see the same price in the spot and future. They will be trading in a different prices.

suppose, let us say that Bitcoin is trading in the spot for 26000$,

but in future, it will be 26100$, why is it that

you will not see the same price between the spot and the future?

here comes the funding fee to minimize the price difference between spot and future.

Funding fee types :

There are two types of Funding fees in future. They are

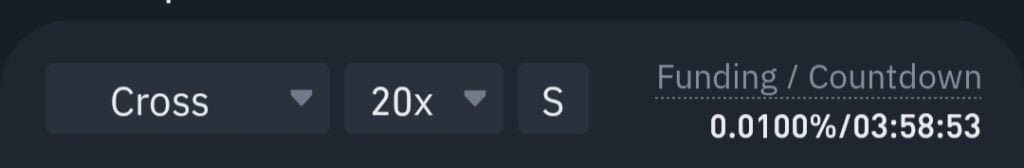

1. Positive Funding Fees

2. Negative Funding Fees

1.Positive Funding Fees

When the Spot price is trading low than the future price in the market. WHEN THE MARKET IS PUMPING, THEN THE FUNDING FEE WILL BE POSITIVE.

Ex: SPOT PRICE : 26000

FUTURE PRICE : 26100

SPOT PRICE < FUTURE PRICE

for example, bitcoin price is trading more in the future than spot price. Here comes funding fees, to reduce the price gap between them.

If you are in a Short position, then the long position holder pays you funding fee.

If you are in long postion , then you will pay the funding fee to the Short postion holders.

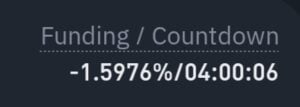

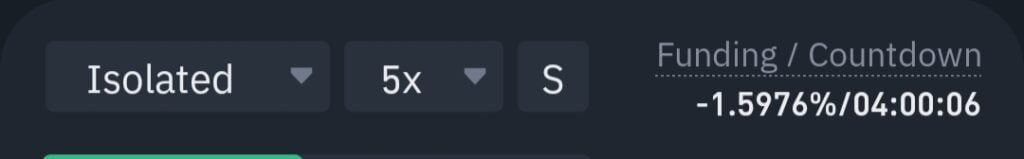

2. Negative Funding Fee:

Negative funding fee is applicable when the spot price is more than the future price, WHEN MARKET IS DUMPING, NEGATIVE FUNDING FEE IS APPLICABLE.

EX: SPOT PRICE: 26000

FUTURE PRICE: 25900

SPOT PRICE > FUTURE PRICE

HERE, Bitcoin is dumping because more people are in a short position. To liquidate short position, the exchange tries to push long position holders by reducing the funding fee.

means, IF YOU ARE IN a LONG POSITION, THEN THE SHORT POSITION HOLDERS WILL PAY YOU FUNDING FEE.

IF YOU ARE IN SHORT POSITION, THEN YOU WILL PAY THE FUNDING FEE TO THE LONG POSITION HOLDERS.

It is a PEER TO PEER transaction , Exchanges will not charge any brokerage fee from them, funding fee is shared between the holders only.

How Funding Fee is Calculated?

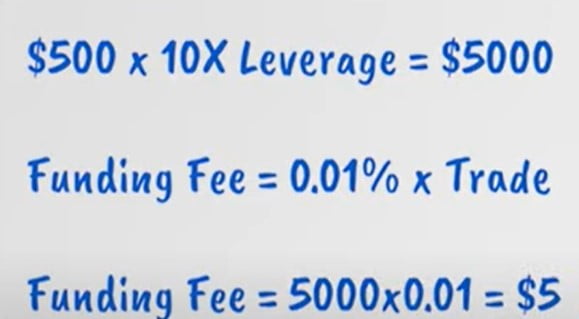

for Example:

For one time

funding fee timings are different in various exchanges.

In BINANCE, the Funding fee is calculated for Every 8 Hours, That means 3 times per day.

For above example:

for 500 $ with 10x laverage= 5000$, your funding fee is 5$ , for Every 8 hours.( 8X3=24 Hours= 1 Day)

5 X 3 = 15 $

per day 15$ funding fee is charged. Per day 3 times funding fee is taken from you.

The funding fee is complicated to calculate because it takes into account factors such as the contract’s price relative to the spot price and the interest rate differential between the assets involved.

Binance Funding fees

Binance offers a feature called “Funding Fees” for trading certain types of contracts on their platform, particularly in their futures and perpetual futures markets, as of my most recent knowledge update in September 2021. These fees are associated with perpetual swaps and futures contracts to ensure that the contract price closely tracks the underlying asset price.

How Funding works on Binance:

Here’s a quick rundown of how funding fees work on Binance:

Binance offers a variety of perpetual swaps and futures contracts for trading, which are derivatives tied to the price of cryptocurrencies such as Bitcoin, Ethereum, and others.

1. Funding Interval: On Binance, funding fees are typically calculated and paid at regular intervals, typically every 8 hours.

2. Funding Fee Rate: Funding fee rates can be positive or negative. It is determined by whether the contract’s price is trading above or below the underlying asset’s spot price.

Who pays who:

Positive Rate: Long positions pay funding fees to short positions if the contract’s price is trading above the spot price.

Negative Rate: When the contract price falls below the spot price, short positions pay funding fees to long positions.

When the funding time occurs, traders with open positions are automatically paid or received funding fees. The fees are settled in the trading pair’s quote currency.

Conclusion:

It is critical to understand that funding fees are not the same as trading fees. Trading fees are charged when you open or close a position, whereas funding fees are payments made between traders on a regular basis to ensure that the contract’s price remains close to the spot price.

Please keep in mind that cryptocurrency exchanges such as Binance may change their fee structures and policies from time to time. To get the most up-to-date and accurate information on Binance’s funding fees and other trading-related costs, visit their official website or contact their customer support.

Bonus Tip:

Binance funding times are

05: 30 AM

01: 30 PM

09: 30 PM

tips for traders are:

if the funding fee is high in your position, then wait for the time to get close and

close your position before the funding fee timings and open the position after the time is started.

by doing these steps you can save your funding fee, do this method when your funding fee is high.

Don’t do this trick when the funding fee is low.

Tip no : 2

- suppose the Funding fee is high in Positive then there is a chance that the coin is in BEARISH.

2. If The funding fee is high in negative then there is a chance that the coin will PUMP.